When we created this blog it was our tactic to emulate the strategy of Eric Jackson and “Plan B” for Yahoo. We intend to use the Internet through blogs to rally support from frustrated shareholders to effect change and implement a “New Strategy”.

In 2000, after the dotcom meltdown, companies such as Microsoft had the opportunity to propel growth through acquisition. Numerous dotcoms and other technology companies had lost tremendous value. Current market volatility has produced a market were companies have record lows. However, record lows create the optimal opportunity for companies such as Microsoft with large amounts of cash to acquire companies at a extreme discount. Based on the concepts within the “New Strategy” it utilizes current market conditions to accelerate growth for Microsoft. Subsequently, time is critical. Therefore, we have pursued a relatively aggressive tactic to rally support expediently.

Based on the reality of market conditions and the optimal opportunity for Microsoft to execute the “New Strategy”, we proceeded to immediately post the “New Strategy” on the blog. There was no real prelude or introduction to reasons that prompted this campaign. However, we currently intend to provide information that prompted this campaign.

In the previous posts we have referenced an email that we received from Microsoft Investor Relations. We also reference Microsoft spending $115 billion in buybacks. We intend to post the origins of this information. Within this post we will provide a copy of the email that we received from Microsoft. We will also provide the majority of the responding letter that we forwarded to Mr. Ballmer.

Microsoft emailed us the following letter:

Dear Mr. Montgomery,

Thank you for your letter to Steve Ballmer regarding your concerns.

Microsoft's primary financial goal is driving long-term shareholder value. We aim to grow operating income faster than our technology peers on a sustained, long-term basis. This goal is balanced with other important priorities that we believe lead to success: winning and satisfying customers, driving innovation, leading the industry transformation to services, and building a broad and deep leadership team.

We are focused on execution which has translated to our revenue and earnings growth. Revenue, operating income, and EPS in fiscal year 2008 all grew by double digit percentages.

We’ll also continue to execute on our financial strategy of returning capital to shareholders through buybacks and dividends. Over the past 5 years we returned over $115 billion to shareholders, allowing Microsoft to offer a very compelling return to our shareholders.

Regards,

Microsoft Investor Relations

In late October 2008, we responded to Mr. Ballmer with the following letter:

Dear Mr. Ballmer

This is in regards to the response we obtained from Microsoft Investor Relations concerning the numerous letters that we forwarded to your attention. We were shocked that the letters were so blatantly dismissed and forwarded to Investor Relations. This disregard reflects your same careless, negligent and poor guidance and decisions for the company.

Investor Relations state “ Microsoft’s primary financial goal is driving long-term shareholder value. We aim to grow operating income faster than our technology peers on a sustained, long-term basis. This goal is balanced with other important priorities that we believe lead to success: winning and satisfying customers, driving innovation, leading the industry transformation of services, and building a broad and deep leadership team. We are focused on execution which has translated to our revenue and earnings growth. Revenue, operating income, and EPS in fiscal 2008 all grew by double digit percentages. We’ll also continue to execute on our financial strategy of returning capital to shareholders through buybacks and dividends. Over the past five years we returned over $115 billion to shareholders, allowing Microsoft to offer a very compelling return to our shareholders”.

This response by Investor Relations is naïve and delusional. The very notion that it states “ Microsoft primary financial goal is driving long-term shareholder value” demonstrates the negligent regard for failing to achieve long-term shareholder value.

In 2004 Microsoft stock was trading for approximately $25 per share. Within a five year period the stock price has continued to fluctuate at approximately $25 per share with minimal variation.

Investor Relations states “this goal is balanced with other important priorities that we believe lead to success: winning and satisfying customers, driving innovation and building a broad and deep leadership team”. The dilemma with this statement is the phrase “ we believe lead to success”. Based on the fact that the stock price has displayed minimal variation within five years, demonstrates that investors fail to share the same belief and have contention regarding the long-term success of Microsoft.

Investor Relations state “ winning and satisfying customers lead to success”. However, numerous reports indicate the dissatisfaction of consumers with Microsoft products. Numerous articles within newspapers and magazines indicate that consumers are frustrated and dissatisfied with Windows, MSN and other Microsoft products. This is reflected in the demand for open source Linux. Microsoft has over the past five years had difficulty in winning and satisfying consumers.

Investor Relations state another goal is driving innovation. Microsoft has failed to achieve this goal.

Apple Inc was previously a company that was languishing. Through the current leadership and management of Steve Jobs the company through innovation has dramatically increased shareholder value. However, within the same period Microsoft has languished.

In 2004, Apple Computer was trading at approximately $7 per share. Within the same five year period as Microsoft trading at approximately $25 per share, the Apple stock has climbed to a high of $210. The company through new management and strategy has created tremendous innovation and shareholder value.

Microsoft has displayed innovation characteristics that are reflective of a reactive strategy as opposed to proactive. Subsequently, in five years Apple has propelled innovation and created tremendous shareholder value while Microsoft has remained at approximately $25 per share and therefore created no value for shareholders. This demonstrates the contrast in which company is innovative and which is a laggard. Apple has created shareholder value while Microsoft has failed.

Investor Relations state “ a important priority that leads to success is building a broad and deep leadership team”. However, the company has failed to achieve this goal and obtain success. Current leadership has failed to create long-term shareholder value. It has failed to win and satisfy consumers. It has failed to drive innovation. Therefore, the company has failed to build deep leadership reflected in the failures of current leadership.

Investor Relations state “we are focused on execution which has translated to our revenue and earning growth”. However, this is inconsequential to investors. Microsoft could increase revenue from $20 billion to $120 billion, however, if investors are not confident in long-term goals it will reflect in the price investors are willing to pay for stock. Regardless of the fact that Microsoft has increased revenue and earnings, the stock continues to trade at the same five year level of approximately $25 per share.

The execution of revenue and earning growth has had no effect on increasing investor confidence and creating shareholder value. Therefore, investors have failed to realize long-term shareholder value.

Investor Relations state “ we’ll also continue to execute on our financial strategy of returning capital to shareholders through buybacks and dividends. Over the past five years we have returned over $115 billion to shareholders.”

In 2004 you stated “ As we looked at our cash management choices, our priorities were to increase our regular payments to shareholders, increase our stock buyback efforts given our confidence in the company’s growth prospects, and distribute additional resources in a special one time dividend”. Through these initiatives created by you and approved by the Board the company has deployed according to Investor Relations approximately $115 billion in capital. This strategy has failed to create shareholder value.

Through your guidance and leadership from 2004 to 2008 the company has deployed $115 billion in capital. In 2004, you stated that it was a priority based on the confidence of the company growth prospects. However, despite deploying $115 billion in capital in the five year period, the stock has remained at approximately the same five year level. Historical charts indicate that the average five year price has remained at approximately $25 per share with minimal increase. Therefore, despite deploying $115 billion in capital this priority has failed to create long-term shareholder value. If investors were confident in this approach the stock price would reflect a higher valuation creating true long-term value.

As mentioned, the company in five years has spent $115 billion and has failed to increase the share price. However, with our proposal had Microsoft in 2004 deployed the same level of capital it would currently be generating an additional $20-$40 billion in revenue and have approximately $80 billion in assets. This strategy would have resulted in investor confidence and ultimately lead to an increase in the share price. However, through current management it has wasted $115 billion through ill-conceived strategies that have failed to create any true long-term value.

According to a report within the New York Times, in 2005 you stated that you had trouble selling the long term value of Microsoft stock even to the company’s own employees. The article indicates that you stated “ Are you buying our stock?” to a team of Microsoft executives, “All the hands were down”.

We are confident that if you presented the same question to current Microsoft executives that it would garner a similar reply. For a period of five years Microsoft stock has performed poorly.

Microsoft was seeking to deploy approximately $50 billion in capital to acquire Yahoo. This acquisition will add approximately $8 billion in annual revenue. Microsoft is additionally required to change Yahoo business model and strategy to compete with Google.

According to an article in the Wall Street Journal, an analyst with Goldman Sachs stated “ Microsoft made what could play out to be the stupidest move in its history: a high ball bid for Yahoo”. Reports indicate that the company was offering a 65% premium for Yahoo. This strategy was pursued by current management and approved by the Board.

According to an article in BusinessWeek, Stefan Selig, global head of mergers and acquisitions at Banc of America states “ With more than $1 trillion in assets controlled by hedge funds, they have credibility and capital. Companies have to take this threat seriously: the balance of power is shifting away from boards and management. You cannot ignore them just because its some hedge fund you never heard of”.

Numerous companies have succumbed to shareholder activism. Companies such as General Motors, Time Warner, McDonalds, Waste Management, Oracle, Sears have had to respond to demands from hedge funds. Small hedge funds such as Breeden Capital forced change at H&R Block. Additionally, Pershing Square forced change at McDonalds. This small hedge fund through a media strategy gained support from dissident shareholders and within one week forced change. At the time of the investment in 2006 McDonalds was trading at approximately $30 per share.

The company had a market valuation of approximately $30 billion. The hedge fund invested in McDonalds. Within one week it through shareholder activism effected change of strategy for McDonalds. The company with a $30 billion market valuation was forced to accept and implement the proposal of the hedge fund.

According to an article with BusinessWeek, numerous large institutions and mutual funds have changed their investment strategy. Several of these firms which would either suffer a loss or sell shares in poor performing companies have recognized the influence of shareholder activism. Therefore, as a result companies such as Fidelity Investments are supporting hedge funds.

We have forwarded numerous letters to your attention. We have indicated that we have strategies that would create long-term shareholder value through deploying capital to new strategies. These letters have apparently been dismissed and the current management will continue to execute its poor strategies.

With five years of poor performance of increasing the company share price, we are confident that there are numerous dissident shareholders. This will include individual shareholders, institutions and mutual funds. As mentioned in previous letters, the five largest Microsoft shareholders control approximately $40-50 billion worth of equity. Each of these shareholders have failed to realize a return on their investment and experience long-term shareholder value. Therefore, we are confident that they will support new strategies that will create true value.

We are also confident that we can rally support from hedge funds. As mentioned, there are numerous funds that collectively manage $1 trillion in assets. Numerous funds currently employ activism strategies to create returns for the funds.

According to reports several firms are expanding and adopting activism strategies to increase returns. We understand that funds have collectively invested to maximize pressure and returns. For example, SAC Capital with $20 billion in assets is investing with Jana Partners with $5 billion in capital to influence TD Ameritrade. We are confident that we can obtain or rally support from hedge funds to influence the adoption of our proposal for Microsoft.

BE ASSURED that based on your dismissal of our previous letters we are going to initiate the strategy of gaining support for the implementation of the proposal. Since this strategy involves deploying capital towards building assets and generating additional revenue it will be supported by hedge funds, institutions and individual shareholders of Microsoft.

The proposal will be implemented with or without you as current CEO. Based on your response to our letters it seems apparent that our initiative will incorporate forcing your resignation as the CEO.

Regards

Craig Montgomery

We are aware that based on the above information there are two strongly conflicting opinions regarding the execution of past strategies and the value that it has created for shareholders. There is also conflicting views concerning the overall performance and future direction of the company. We do not want to appear bias towards our “New Strategy” that will create true value for Microsoft. Therefore, we will provide additional information to support our views and concerns. Ultimately, these facts will be left for discretion to determine which party has the correct view and which party is delusional.

CONCLUSION

Microsoft states that its primary financial goal is driving long term shareholder value. According to CBS Marketwatch and other historical share data, Microsoft has for a period of “long-term” traded at approximately $25 per share.

As reflected in the stock chart, Microsoft since 2004 has experienced minimal variation. It had a minor rally when Microsoft announced the potential acquisition of Yahoo. As noticed in the chart, it rallied to approximately $38 per share in February 2008, at the time Microsoft offered $45 billion to acquire Yahoo in an effort to narrow the market share margin with competitor Google.

After the rejection of the bid by Yahoo, the stock has declined to a level reflective of the past four years. Despite Microsoft deploying $115 billion in stock buybacks, the stock continues to languish with no creation of “long-term” shareholder value.

The annual P/E chart shows a clear downtrend, which keeps negating the positive impact on share price that otherwise might be expected from what earnings gains have occurred.

In addition to deflated P/E , there is subsequently the potential for “earnings” to decrease as well. This will be discussed in greater detail.

Microsoft states that with its financial goal of creating lasting long-term shareholder value, that it includes within its priorities that lead to success: winning and satisfying customers, driving innovation, and leading the industry transformation to services.

Microsoft states within the email The Crandrea Group received, that its priority is “driving innovation” which will both win and satisfy consumers.

1)Microsoft claims that Vista was a success.

Management claims it “sold” 150M licenses and subsequently hails that “success”. But, in reality given a ludicrous 5 year gestation period and reported $5-$6B price tag, media reaction, corporate adoption, FPP retail sales, the company’s own expectations, and most important the competitive need – it’s a drastic disappointment.

As illustrated within the two graphs, Microsoft has from the third quarter of 2007 to the third quarter of 2008 lost market share to Apple. These graphs only reflect a one year period. Charts with wikipedia illustrate that since 2006 Microsoft has been losing market share within the operating system sector. Apple is gaining momentum with winning customers and Microsoft has progressively losing its market share.

There is additional information provided within the wikipedia chart concerning Operating System Market Share. This chart can be accessed at http://en.wikipedia.org/Usage_share_of_desktop_operating_systems or by clicking on our link contained in this site. Microsoft launced Windows XP in 2001. It launched its update operating system Vista in 2006. The NetApplications chart illustates that approximately in 2008, 69% used Windows XP and 17% used Vista. Despite Microsoft hailing it a success, despite five years of development and a $5-6 billion cost to develop, only 17% use Vista and the majority of consumers have remained with the older Windows XP. Subsequently, this chart demonstrates the failure of Vista and Microsofts failure to win and satisfy consumers with "New Innovation".

The chart also demonstrates that Mac OS with Intel and PPC has collectively grown from approximately 4% in 2006 to 8% in 2008. Microsoft according to the chart has failed to capture consumers while Apple has gained 4% market share in a two year period.

Microsoft through advertising has resorted to creating the mojave campaign. Reality, regardless of calling it mojave, vista, or even windows, consumers are not satisfied. Competitors such as Apple recognize this consumer frustration and have created a advertising campaign that incorporates a mac and a PC. The ads sarcastically exploit that Microsoft fails to call the system vista. These ads by Apple continue to increase the exodus of consumers from Microsoft to Apple. Therefore, it seems that Microsoft is trying to reclaim consumers through hiding the fact its really vista. During the same time Apple is winning and satisfying customers with innovation.

We will be kind to Microsoft and we will at this point not discuss “Longhorn” and the dramatic impact it received from investors concerning the confidence in the management team and the overall company strategy.

Leadership are also delusional about the future implications that this underwhelming release represents. Windows market share, while still above 90%, has fallen . And others, particularly Apple, have been steadily gaining share. Consumers have voiced dissatisfaction with Microsoft and subsequently an exodus to competitors has impacted Microsoft.

More importantly, Microsoft has begun to relinquish undisputed technical leadership in desktop Operating Systems , the core of what the company does, to Apple. It’s difficult to calculate how much of a strategic impact that will have on Microsoft. Although Microsoft will argue that it has increased revenue and earnings, if activity within this sector remains constant for the next four to five years how will Microsoft’s revenue and earning appear?

In four to five years will there be a continued report by Microsoft that revenue, earnings and EPS have grown by double digits?

The possible answer to that question is a resounding “NO”. There is the potential Microsoft will surrender revenue and earnings to Apple and Linux with double digit loss.

The chart at wikipedia illustrates that Mac OS has grown from approximately 4% to 8%. If this growth is maintained there is the potential that within the next four to five years Mac OS could capture 20-25% of the operating system market. Based on the poor response of Vista (17% of market share), if Windows 7 receives a similar consumer response as Vista there is the potential that Mac OS will obtain more than 20-25% of the market.

The only savior for Microsoft is that Windows 7 will be the must-have product that Vista failed to accomplish. Microsoft is required to market a more compatible Operating System to have any chance of keeping up with OS X and Linux. The reality or “Success” as Microsoft stated in the email, is for Windows 7 being customer friendly and ultimately stopping share erosion at whatever level it has dropped to by then.

2) We have a “Success” strategy in Online Market Share.

Microsoft’s Online efforts have been a massive expensive and ultimate disaster. Microsoft’s performance has been the worst of the four major players. It has lost considerable market share to Google. The company Google, has a considerable margin in contrast to Microsoft.

In an effort to eradicate the substantial margin between Microsoft and Google the company attempted a bid for competitor Yahoo. This strategy resulted in Microsoft offering a 65% premium bid for languishing Yahoo. The bid ultimately was valued at approximately $45 billion. This strategy would have resulted in deploying $45 billion in capital to establish an additional $7 billion in revenue and $600 million in net income. However, these revenue and earnings are contingent on if Yahoo through the merger had the ability to sustain 2007 revenue and earnings levels.

If the acquisition proved successful, Microsoft would have increased annual revenue from $60 billion to $67 billion. Net income for the company would have increased from $17 billion to $17.6 billion. This is based on 2007 Yahoo Annual Reports. Therefore, Microsoft would have spent $45 billion to achieve a modest gain in both revenue and net income. Spending $45 billion to achieve a $600 million increase in net income fails at presenting characteristics of a company driving innovation and winning customers. It is more reflective of a company that failed to recognize the significance of the Internet and like a prehistoric dinosaur is trying to avoid extinction.

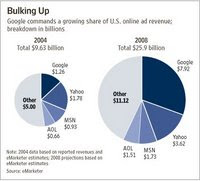

As demonstrated by the above chart, Microsoft and Yahoo combined fail to control as much market share as Google. Within this sector Google experiences a similar characteristic as Microsoft in the operating systems sector. Microsoft has experienced a near monopoly in the operating system sector. Despite a decline in operating system market share Microsoft controls relatively 90% market share. However, illustrated in the above chart, in this sector of service Google experiences a near monopoly. Subsequently, Microsoft is required to adopt a strategy that will enable the company to compete with Google. Currently, Google has 80% market share.

The acquisition according to Charlene Li of Altimeter Group and formerly an analyst with Forrester Research states “the bid appeared beneficial on paper, however, the reality of making the two companies work would have been a nightmare. There are numerous overlaps which would have made the integration complex when all Microsoft requires is the search deal”.

Microsoft despite deploying billions to create an online service and attempting to deploy $45 billion in additional capital, its online service continues to be outpaced by Google. The reality is that its consumer online satisfaction has failed to prove successful and fails to capture consumer satisfaction at the same growth rate as competitor Google.

It has become evident the plan hasn't worked, which is the main reason Microsoft tried to buy its way into competitiveness by acquiring Yahoo, a deal evaporated in May 2008, when Microsoft withdrew its bid for the Internet company.

3) Microsoft believes that it is “Successful” in obtaining consumer satisfaction with Xbox.

Xbox, while financially more successful than the Online division or sector on a comparative basis, it has been a financial disaster. More than twenty billion dollars “invested” over nearly a decade. The reality is that Microsoft has failed to maintain competitive consumer loyalty especially with the introduction of Wii and its increasing popularity. The reality, it’s conceivable that Microsoft will finish last of three main competitors.

4) "Microsoft is “Successful” in driving innovation and gaining consumer loyalty through mobile services".

Microsoft has been pursuing mobile services and attempting to obtain consumers for several years. It has created and launched the “o” phone. It has established alliance with Sprint Nextel. However, the result is Microsoft is losing market share to Apple and its iphone. While there has been better success in the smartphone sub-segment, Apple has surpassed Microsoft in less than one year. Additionally, Research in Motion through its Blackberry is also obtaining competitive market share to Microsoft.

Considering this set of competitors, and Microsoft’s failure to propel innovation, Microsoft could potentially lose additional market share to its competitors.

Subsequently, based on the historical data concerning Microsoft, it has failed at its priority of satisfying customers and driving innovation. Microsoft based on data, has failed at remaining innovative and maintaining customer satisfaction.

Based on Microsoft’s performance in contrast to its competitors (Apple and Google) numerous shareholders are speculating how Microsoft will succeed in future strategies. Competitors have been able to sustain successive growth and earnings through modest R&D expenditures and new product/service offerings, and yet the largest R&D spending company has failed to remain competitive.

Microsofts largest effort to remain competitive was the poorly conceived and executed bid for Yahoo. This strategy failed to obtain support from numerous Microsoft shareholders. The majority of shareholders are relieved Microsoft abandoned its premium bid to acquire Yahoo. This strategy, if it proved successful,would have cost $45 billion to achieve what a “search” only deal could accomplish.

Microsoft will continue to operate. However, will it continue to languish. Apple in 2004 was trading at approximately $7 per share. Through the leadership of Steve Jobs, the company drove innovation and secured consumers. As a result, the market responded and shares have increased in 2008 to surpass $200 per share. Subsequently, Apple was successful in driving innovation and obtained customer satisfaction. The mac and iphone have obtained market share from vista and Microsoft Mobile. The market has responded, and Apple succeeded in creating shareholder value. This first and foremost is to be the goal of every company. The primary goal of every company management is to create shareholder value. Despite, Microsoft stating in its email that it was a primary goal, it has failed to create shareholder value similar to its competitors.

In 2004, if an investor acquired shares in Microsoft the investment according to historcial charts will have expereinced minimal return with the share value remaining at approximately $25 per share. Therefore, the investor will have realized "NO" return, unless the investor sold in February 2008 when Microsoft rallied to approximately $40 per share. However, if the investor failed to sell during that minor rally, the portfolio will currently be expereincing a negative return.

If an investor in 2004 acquired Apple shares at $7 per share, charts indicate that the investment would have increased to $210 per share in February 2008. Simple math demonstrates that equates to a gain of $203 per share. The comparasion between Microsoft and Apple is simple. An investor in 2004 could have spent $25 per share for Microsoft stock and expereince it increase to $40 per share in February 2008. The alternative, the investor could have spent $7 per share to acquire Apple stock and within the same period witness the shares valued at $210 in February 2008.

The reality is simple to determine. In 2004 the entry level was $25 per share for Microsoft. Currently, the Microsoft shares are trading below the entry level at approximately $18-19 per share based on market fluctuation. In 2004, the entry price for Apple was $7 per share. It with current market volatility has declined to approximately $90 per share. It is still simple to determine that Microsoft has produced a negative impact while apple is worth 12 times higher than the entry price. Apple is a gain of $83 per share.

In 2004 the market valued Microsoft shares at $25 per share. In 2004, the market valued Apple at $7 per share. Based on current market volatility Microsoft has declined to below 2004 levels. Therefore, logically we would have to draw the conclusion that Apple would expereince similar reaction from the market. However, Apple trades well above its 2004 share valuation. An individual that invested in 2004 to acquire shares of Apple would have regardless of market volatility expereinced a substantial gain. This creates the question, what is truly volatile the market or Microsoft?

In the next four years, what will the historical charts of Microsoft’s shares appear or reflect?

From 2004 to 2008 it has fluctuated at $25 per share. As outlined in the data it is losing market share to competitors. This includes losing market share in its valuable Operating System monopoly. It has begun to already loss share in this sector. Being proactive and looking forward, in four years during 2012, what will be Microsoft’s market share in Operating Systems, online services, home entertainment and mobile services?

Although the company has experienced an increase in revenue, without a “New Strategy” will shareholders in the future witness that revenue growth erode as competitors continue to outpace Microsoft?

3-5 years from now (maximum), growth in the cash cows might diminish, this will dramatically impact the potential for shareholder value. There is the potential for Google, RIM, Apple and other competitors to seize additional market share from Microsoft. There is the potential that if Apple continues with similar success, Microsoft will witness its 90% operating system market share diminish further.

All of this assumes Ballmer is still at the helm of course, which sadly and ironically is very probable. Despite, poor performance during his tenure, he continues to preside over the strategic direction and ultimately the fate of shareholder value. What is perplexing is that activist hedge funds target other companies that have languished for equal or shorter durations.

Carl Icahn has acquired numerous shares of Yahoo. Reports indicate that Icahn Partners recently acquired an additional 7 million Yahoo shares. Articles indicate that Icahn Partners were dissatisfied with Jerry Yang and Yahoo. Numerous media articles state that Mr. Icahn was instrumental in supporting Microsoft bid and the proposed acquisition of Yahoo. The activist fund is willing to discuss with Mr. Ballmer the benefits of a 65% premium bid for Yahoo. It’s ludicrous that this activist fund would rally support behind a $45 billion, 65% premium bid for Yahoo and believe that it’s a viable strategy for Microsoft.

What’s confusing is that activists have failed to target Microsoft. Through our initial research we discovered some hedge funds that in August 2008 held Microsoft stakes, however, in their November SEC filings they had liquidated holdings. Liquidating shares has no effect on the direction of the company other than potentially forcing shares further down as its creates more volatility and pressure on other investors portfolios.

Under a Ballmer-led administration, expect more of the same results. Expect more lack of innovation and consumer satisfaction. Expect continued poor share performance and creation of shareholder value. Expect Mr. Ballmer to pursue similar strategies.

According to the email that we received, Mr.Ballmer intends to continue with the strategy of deploying billions of dollars worth of capital towards stock buybacks. Despite this strategy and its failure to elevate the share price, Mr.Ballmer makes it clear it will continue with the same course of action. That strategy appears ridiculously redundant. If you were in a boat paddling towards a waterfall, perhaps Niagara Falls, and realized it was getting closer, would you continue in the same pursuit of action or would you attempt an alternative strategy?

Another analogy, if you were the Captain of the Titanic and were warned of the ensuing iceberg would you attempt evasive action?

As the Captain, would you turn the wheel and put the propellers in reverse to avoid the collision?

Icahn Partners in a letter to Yahoo shareholders stated “the company is moving towards a precipice”. Microsoft based on losing its grip on the PC market, poor performance in online services, poor performance of mobile services, is subsequently moving towards a precipice. However, reflected in the email that we obtained, Mr.Ballmer is adamant on continuing to paddle the boat towards the waterfall as opposed to seeking a “New Strategy”and, is as the “Captain” stating 'throttles full ahead' to accelerate the pace we hit the iceberg. It’s time Mr. Ballmer realize it's time to stop paddling in the same direction and it’s time to reduce throttle before shareholders are either taken over the waterfall or hit the iceberg at full throttle.

It’s time to stop deploying capital towards stock buybacks. In the next four years will Microsoft spend another $115 billion with the same failing results to elevate shareholder value?

Without a rally of shareholders and a “New Strategy", Mr. Ballmer and current management will continue with a general lack of accountability and urgency within the senior management ranks, a lethargic like approach to creating strategic focus on long-term growth and will fail to create shareholder value.

Attempting to protect the cash cows and inadequate attention to the product innovation, and its related failure to spot new trends and get out in front of them (invariably resulting in a desperate, expensive, and often unsuccessful attempt to play catch up later with a 65% and $45 billion bid for another failing company), a staggering annual R&D expenditure that produces minimal technology innovation and even fewer successful new products, poor execution of strategies ( the premium bid for Yahoo), ultimately Microsoft will become its own folly to the detriment of shareholders.

Through the current leadership team and its strategy of creating shareholder value, driving innovation, satisfying customers and pursuing stock buybacks, the reality is within the next four years will Microsoft loose more market share and therefore shareholder value?

The reality is the market sees Microsoft losing its grip on computer users and having nothing to take its place when those users start leaving. There has already been an marginal exodus to mac and Linux, and AT&T with iphone is outpacing Microsoft Mobile. The market is a forward looking mechanism and senses that at Microsoft there's a greater chance of losing market share than gaining market share. Subsequently, the market reflects this fundamental truth in the value that investors are willing to pay for the stock.

Within this analysis we presented a P/E chart that we stated would be discussed in greater detail. Typically, stocks with higher forecast earnings growth will have higher P/E ratios. Those with expected lower earnings growth will have a lower P/E to reflect this expectation.

The company Apple generates $32 billion in annual revenue and has a market capitalisation of $76 billion. The company P/E is currently 16.

The company Google generates $16 billion annually and has a market capitalisation of $93 billion. The company P/E is 18.

Microsoft generates the highest level of annual revenue with $60 billion. It has a market valuation of $170 billion. Its current P/E is 10.

The market is a forward looking mechanism. The market realizes Microsoft is losing its dominant operating system market. The market reflects the expectation of future earnings growth potential and its reflected with the low P/E. The market has demonstrated its belief in Microsoft and the company ability to propel future earnings growth.

Therefore, it can be concluded that despite the fact that Microsoft states “its priority is shareholder value, driving innovation, satisfying and winning customers”, that it’s failing to be successful in these goals. It can also be concluded that it will continue with the same failing strategy. This will be detrimental to current and future shareholders.

It is time that shareholders rally support. It is time that shareholders indicate a “New Strategy”.

The reality, shareholders are in the boat heading towards the waterfall or shareholders are on the Titanic. Regardless of the analogies, it’s time for shareholders to take the initiative and gain control of the boat before shareholders are swept over a waterfall or hit a iceberg.

It is time to take control and rally support. It is time to adopt and execute a “New Strategy” that will avoid future disaster and loss of market share and shareholder value.

As mentioned in previous blogs, we are seeking to rally support for a “New Strategy”. The strategy incorporates three main ideas.

1) Acquire a major bank. We recommend ING. It provides global presence. It offers online services through ING Direct. It enables Microsoft to obtain a valuable asset. It enables Microsoft to increase revenue and offset a potential future decline in revenue through current operations. Microsoft can acquire a major bank that will add according to 2007 reports, $211 billion in annual revenue. This acquisition can with current valuations be achieved by spending approximately $17 billion.

2) Microsoft acquires Sprint Nextel. Microsoft has attempted to gain consumers in this sector. It includes creating an alliance with Sprint. Apple and iphone are gaining market share. The Sprint acquisition enables Microsoft to increase revenue by $40 billion annually. This acquisition at current market valuations would require Microsoft spending $7 billion. This includes offering a modest premium based on current values. Microsoft should not be content with an alliance that provides modest revenue when it has the capacity to acquire Sprint and increase revenue by $40 billion.

3) Microsoft should enter negotiations with Yahoo for a “search” only deal. It can obtain an increase in market share and become competitive with Google. This “search” only deal will cost Microsoft approximately $3-5 billion.

The “New Strategy” enables Microsoft to increase annual revenue to potentially surpass $300 billion annually. It has the capacity to increase net income to $30 billion annually. It enables Microsoft to accelerate growth in both online and mobile sectors. It enables Microsoft to offset the potential decline in revenue based on losing market share in its monopoly Operating System division.

Numerous companies missed the opportunity to accelerate growth during the dotcom meltdown. As mentioned, valuations are at record lows. Microsoft can currently spend less than its proposed Yahoo bid and acquire assets that will add an additional $260 billion in annual revenue.

We will continue to post blogs and rally support. In the New year we will post more information concerning recent developments. We wish all Happy and Safe holidays. We look forward with anticipation to the “New year” and the potential of the “New Strategy”.